Germany's car stimulus package

Smaller vehicles will profit a lot from the new program

I'm Markus - a strategy consultant based in Munich, Germany. In this newsletter I will collect, classify and share the most interesting information from the exciting world of mobility and take a look at the business and operating models behind.

I have promised that my next article will focus on direct sales; but last night the German government decided to launch an economic stimulus package that could have a major impact on electrified vehicle sales, especially for smaller cars. So today I will give you a short update with some new data and estimates.

Enjoy,

Markus

The Electric Car Stimulus Package

Let's start with the facts:

The German government has decided to reduce VAT to a temporary 16% from July 1, 2020. This will benefit all car purchases, provided that the reduction in final prices is not offset by price increases by dealers.

It was also decided that the purchase of purely electric cars will in future be subsidised with 3,000 euros in addition to the 3,000 euros already granted by the state and the 3,000 euros subsidy from the manufacturers (max net list price for the increases subsidy: 40,000 euros, valid until 31.12.2021).

Since the beginning of 2020, drivers of electrified cars as company cars have only had to pay monthly flat-rate tax on their private routes at 0,25 percent of the gross list price monthly, given the vehicle price is below 40,000 euros. This price limit. This price limit has now been increased to 60,000 euros.

It was also decided to further expand the charging points. In my opinion, the topic of charging stations is more of a psychological one; in some places there are still a lack of quick chargers (called "HPC chargers"), but there are already more charging points than filling stations in Germany and the expansion is progressing well. But any promotion of electric cars in Germany must also include promoting the expansion of charging points ;-) In a way, this is a subsidy that benefits the automobile companies, as they would otherwise have to finance the infrastructure out of their own pockets (nobody buys an electric car if they cannot charge it. However, less than half of all people in Germany are potentially able to charge privately, so public chargers are needed). Therefore I have included it here for the sake of completeness.

In the last few days there has been much discussion about a state car purchase subsidy. Critics said that the 2008/2009 financial crisis had taught us that there were few long-term effects. Proponents claim the opposite: a Keynesian straw fire is exactly what is needed now, there a lots of car dealers with significant problems.

No matter how you look at it, it is surprising that only electric cars are directly subsidized, as in the last few days there has also been a discussion about whether internal combustion vehicles will also be promoted directly (and not only indirectly via the VAT reduction).

Potential Impact on Leasing Rates

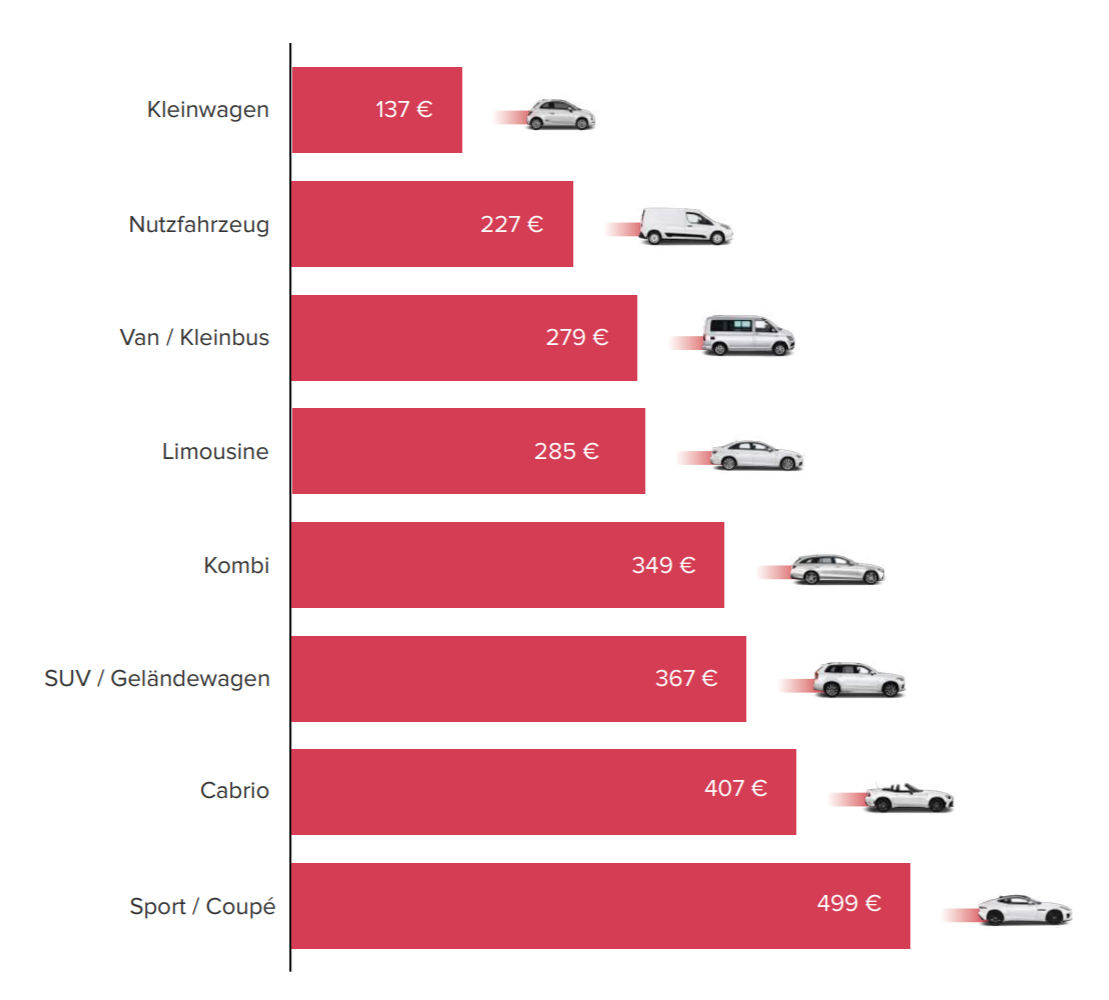

To understand the impact of the car stimulus package, let’s start with the fact that Germany has a huge market for leased cars. As you can see on the graphics (Leasingmarkt study, 2020) mainly large vehicles like SUVs are being leased.

The decline in leasing for small vehicles in 2019 was very significant (from 19.4% to 12.7%) too. Over the last years, there is this trend that small cars are an endangered species. This has 1+1 reasons:

The technology required to meet the CO2 emission targets is complex

Complex technology increases prices

High prices for smaller cars make them less attractive compared to higher segments. The average for small cars is a monthly leasing rate of 137 euros.

Small electric cars will by far be cheaper than ICE cars

Compared to that average leasing rate, a small electric car like the Volkswagen e-Up would cost more than 300 euros per month for three years without state support (rough estimate by me, but more or less right for the german market). This is of course far too expensive if the industry average is only 137 euros per month. It would take a strong conviction of electric mobility to accept this difference if you were to get a combustion engine sedan (285 euros average leasing rate p.m.) instead of this small electric car.

If you include the state subsidy and the manufacturer's premium, the picture is completely different. The leasing rate (138,89 euros) of the VW e-UP is exactly at the industry average of 137 euros. No chance for an ICE sedan here.

And this is where the increased car subsidy comes into the game.

Summary

With the new regulation, the VW e-Up is now cheaper than the industry average for the first time and will cost the lessee only 55,56 euros per month. The leasing rate is more than halved compared to the existing subsidies. While in a higher-value segment (e.g. the BMW i3) it also changes downwards, but does not by far have the same impact as for small cars.

In other words: there is now a very strong argument for choosing an electric car in a small car fleet or even privately. The German government has thus established even more than price parity between combustion engines and electric vehicles. And: My calculation example here does not even take into account the sales tax reduction.

This is really good because small vehicles are mainly used in the city, where the advantages of electric vehicles are particularly great (local zero emissions) and the disadvantages are much smaller (limited range).

Limitations

I can actually see only two reasons why this should not lead to a significant increase in registrations of small electric cars:

Price stability/ Price increases: The potential reduction in final prices with the higher subsidies is offset by price increases by dealers (synthetic demand constraint).

Delivery times: As most car manufacturers are expected to meet the European CO2 emission limits in 2020, some manufacturers will try to move registrations to 2021 (synthetic supply constraint).

Exciting times. Feel free to take a look at the ADAC's electric car leasing deals.

Stay tuned and

Hi Markus, I live in China so I wonder in your illustration of e-up!, how much is the initial payment and interest rate? And the residual value was 50% of original price before environment bonus, is it reasonable?